UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A INFORMATION

(RULE 14A-101)PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:(Amendment No. )

|

|  | Filed by a Party other than the Registrant |

| Preliminary Proxy Statement |

| Confidential, |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material under §240.14a-12 |

|

|

|

DUCOMMUN INCORPORATED

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Thanother than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| Payment of Filing Fee (Check all boxes that apply): | |||||

| No fee required. | ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

|

| ||||

| Fee paid previously with preliminary materials. | ||||

|

| ||||

|

|

|

| |||

|

| |||

|

|

Ducommun Incorporated 2021 Proxy Statement

Message to our Shareholders

Stephen G. Oswald

Chairman, President and

Chief Executive Officer

Dear Fellow Shareholders:

| ||

|

|  |

Dear Fellow Shareholders, itIt is my pleasure to invite you to the 20212024 Ducommun Incorporated Annual Meeting of Shareholders.Shareholders (the “Annual Meeting”).

Due

Once again, our Annual Meeting will be conducted online through a live audiocast, which is often referred to as a “virtual meeting” of shareholders. Our digital format will allow our shareholders to participate safely, conveniently, and effectively, from any location with access to the public health impact ofInternet. We intend to hold our virtual Annual Meeting in a manner that affords shareholders the COVID-19 pandemic,same general rights and out of concern foropportunities to participate, to the health and safety of our shareholders, employees and directors, this year’s annual meeting will be held virtually. extent possible, as they would have at an in-person meeting.

The annual meetingAnnual Meeting will be held on Wednesday, April 21, 202124, 2024 at 9:00 a.m., Pacific Time and you will be able to attend the annual meeting online, vote your shares electronically, and submit your questions by visiting www.virtualshareholdermeeting.com/DCO2021DCO2024 and entering your control number. You will not be able to attend the annual meetingAnnual Meeting in person. The attached Notice of Annual Meeting of Shareholders and Proxy Statement discuss the items scheduled for a vote by shareholders at the meeting.

The Securities and Exchange Commission rules allow companies to furnish proxy materials to their shareholders over the Internet. As a result, most of our shareholders will receive a notice in the mail a notice regarding the availability of the proxy materials for the annual meetingAnnual Meeting on the Internet instead of paper copies of those materials. The notice contains instructions on how to access the proxy materials over the Internet and instructions on how shareholders can receive paper copies of the proxy materials, including a proxy or voting instruction form. This process expedites shareholders’ receipt of proxy materials and lowers the cost of our annual meeting.Annual Meeting. The Board of Directors has fixed the close of business on February 23, 2021,26, 2024, as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting.

During 2020, I took the opportunity

In 2023, with management continuing to increase my holdingsbuild on its demonstrated track-record of Ducommun stock, personally purchasing 72,500 shares. This activitystrong operational leadership and cost management, along with my other holdings now has me among the top 20 largest shareholderscontinued improvement in the companycommercial aerospace market and certainlya solid defense business, our interests are aligned.shareholders were the beneficiaries of a more than 25% year-over-year increase in market capitalization, a new all-time annual revenue record of approximately $757M, increased margins and a relative total shareholder return that continues to consistently outperform others in our proxy talent peer group. I also want to thankwelcome our newest Board member, David Carter, to the Company. It is the first time our Board has had someone with David’s extensive engineering leadership experience and we are thrilled with the expertise and perspective that he will bring to our Board. Thank you as well to our shareholders for sticking with us in 2020 and supportingtheir support of the company,Company, my team and our boardBoard are excited about the future as we gavehead into our best efforts addressing the many challenges and crises.175th year of business.

Finally, it is important that your shares be represented and voted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please sign, date and return the enclosed proxy card or vote by telephone or using the internetInternet as instructed on the enclosed proxy card. Please vote your shares as soon as possible. This is your annual meeting,Annual Meeting, and your participation is important.

Sincerely,

Stephen G. Oswald

Chairman, President and Chief Executive Officer

Ducommun Incorporated 2021 Proxy Statement

DUCOMMUN INCORPORATED

200 Sandpointe Avenue, Suite 700

Santa Ana, California 92707-5759

(657) 335-3665

April 24, 2024

(657) 335-3665DATE & TIME:

Wednesday, April 24, 2024

9:00 a.m. Pacific Time

PLACE: Online via live audio webcast at

www.virtualshareholdermeeting.com/DCO2024

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 21, 2021

|

| ||||

|

| ||||

| 1. | Elect three directors named in the Proxy Statement to serve on the Board of Directors until | ||||

| Approve | ||||

| Approve the Company’s 2024 Stock Incentive Plan | ||||

| 4. | Ratify the selection of PricewaterhouseCoopers LLP as | ||||

| Transact any other business as may properly come before the meeting or any adjournment | ||||

| By Order of the Board of Directors | |||||

| Santa Ana, California March 13, 2024 | Rajiv A. Tata Secretary | ||||

NOTICE

of Annual Meeting

of Shareholders

RECORD DATE:

February 26, 2024

The Board of Directors unanimously recommends that you vote your shares “FOR” the election of the one director nominee named in the Proxy Statement and “FOR” each of the other proposals above.

Your vote is very important. Please read the proxy materials carefully and submit your votes as soon as possible by the internet, telephone, or mail. Submitting your votes by one of these methods willset forth below to ensure your representationshares are represented at the 20212024 Annual Meeting of Shareholders (the “Annual Meeting”) regardlessShareholders. Instructions for accessing the virtual annual meeting are more fully described in the accompanying proxy statement and a list of whether you attend the Annual Meeting.

Due to the continuing public health impactregistered shareholders as of the coronavirus (“COVID-19”), and to support the health and well-being of our shareholders and employees, the Annual Meetingrecord date will be held exclusively online via live audio webcast on the above date and time. You or your proxyholder will be able to attend the Annual Meeting online, vote your shares electronically, submit questionsaccessible during the meeting and examine our listat www.virtualshareholdermeeting.com/DCO2024. The record date for the annual meeting is February 26, 2024. Only shareholders of shareholdersrecord at the Annual Meeting by visiting www.virtualshareholdermeeting.com/DCO2021 and using your 16-digit control number included inclose of business on that date may vote at the Notice of Internet Availability of Proxy Materials, on your proxy card,annual meeting or in the instructions that accompanied your proxy materials.

In the event of a technical malfunction or other situation that the meeting chair determines may affect the ability of the Annual Meeting to satisfy the requirements for a meeting of shareholders to be held by means of remote communication under the Delaware General Corporation Law, or that otherwise makes it advisable to adjourn the Annual Meeting, the chair or secretary of the meeting will convene the meeting at 10:00 a.m. Pacific Time on the date specified above and at our address specified above solely for the purpose of adjourning the meeting to reconvene at a date, time and physical or virtual location announced by the meeting chair. Under either of the foregoing circumstances, we will post information regarding the announcement on the investors’ relations page of our website at https://investors.ducommun.com.

By order of the Board of Directors

Rajiv A. Tata

Secretary

Santa Ana, California

March 8, 2021any adjournment thereof.

Important notice regarding the availability of proxy materials for the shareholder meeting to be held on April 21, 2021:24, 2024:

The Notice of Annual Meeting, our Proxy Statement and our Annual Report to Shareholders are available at http://materials.proxyvote.com/264147

Ducommun Incorporated 2021 Proxy Statement

| ||||||||

| ||||||||

| ||||||||

|  | |||||||

| Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you. | BY INTERNET Go to www.proxyvote.com and follow the instructions | BY TELEPHONE Call 1-800-690-6903 prior to 11:59 pm on April 23, 2024 | BY MAIL Sign the enclosed proxy card and mail it promptly in the enclosed postage- prepaid envelope | AT THE MEETING See page 83 for more information. | ||||

Ducommun Incorporated 2021

| Back to Contents |

Proxy StatementSummary

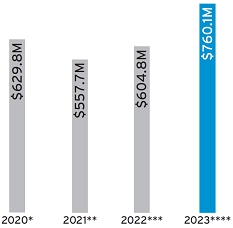

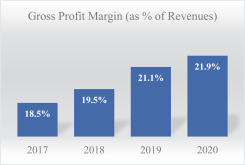

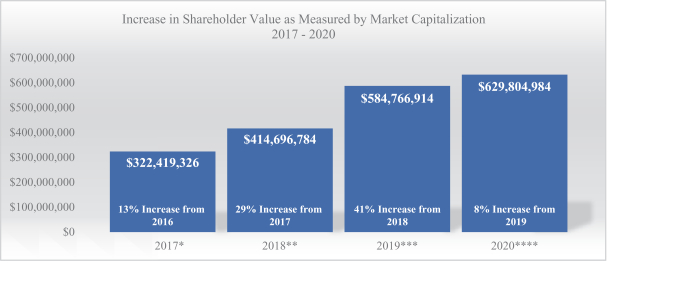

RECENT PERFORMANCE ACHIEVEMENTS

This proxy summary of our recent performance achievements highlights information generally contained elsewhere in this proxy statement.Proxy Statement. This summary does not contain all of the information you should consider, and we encourage you to read the entire proxy statementProxy Statement before voting your shares. For additional and more complete information regarding our 20202023 performance, please review the Company’sDucommun’s Annual Report on Form 10-K for the year ended December 31, 2020.

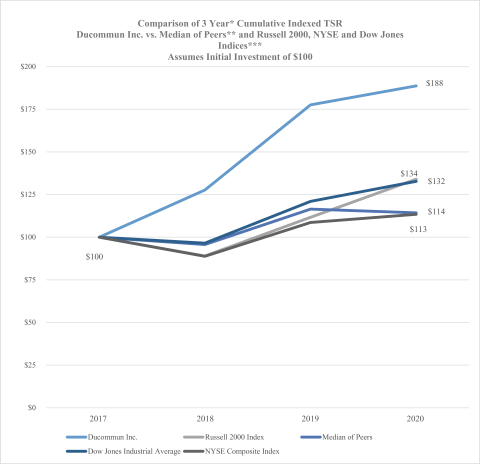

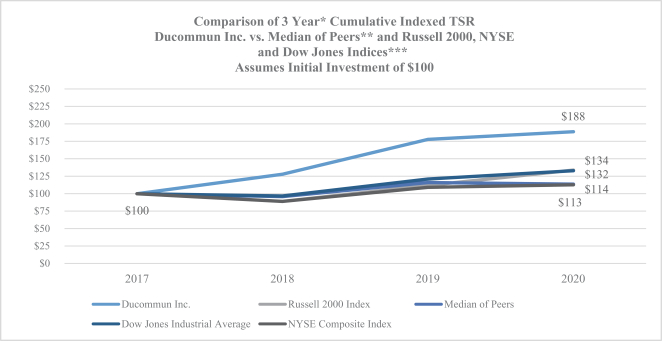

TOTAL SHAREHOLDER RETURN vs. PROXY PEERS, RUSSELL 2000 AND SELECTED INDICES2023.

* Data for each year depicted in the graph above is as of December 31 of each year.

** Peer group data does not include Wesco Aircraft Holdings, Inc., which was acquired by Platinum Equity in January 2020.

*** Included to depict Ducommun’s performance against the broad, general market.

|

Ducommun Incorporated 2021 Proxy Statement

Cumulative Total Shareholder Return as of December 31, | ||||||||

2017 | 2018 | 2019 | 2020 | |||||

Ducommun Incorporated | $100 | $128 | $178 | $188 | ||||

Russell 2000 Index | $100 | $89 | $112 | $134 | ||||

Median of Proxy Peers | $100 | $96 | $116 | $114 | ||||

NYSE Composite Index | $100 | $89 | $109 | $113 | ||||

Dow Jones Industrial Average | $100 | $97 | $121 | $132 | ||||

Our relative total shareholder return (“TSR”) compared to the Russell 2000 Index over the 3-year period between 2018 and 2020 was in the 86th percentile, ranking 235th out of 2000 companies1.

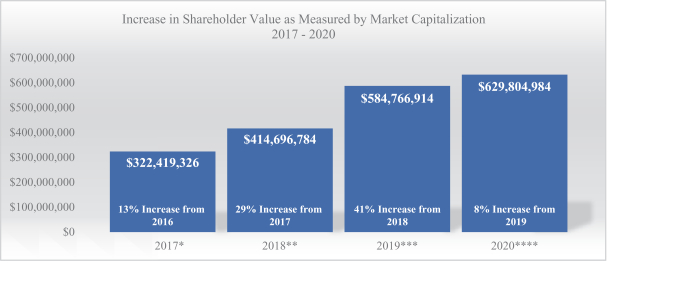

* Based on 11,332,841 shares outstanding and closing price of $28.45 per share as of December 31, 2017.

** Based on 11,417,863 shares outstanding and closing price of $36.32 per share as of December 31, 2018.

*** Based on 11,572,668 shares outstanding and closing price of $50.53 per share as of December 31, 2019.

**** Based on 11,728,212 shares outstanding and closing price of $53.70 per share as of December 31, 2020.

|

|

Ducommun Incorporated 2021 Proxy Statement

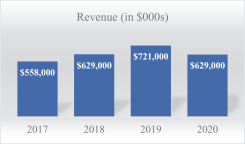

|

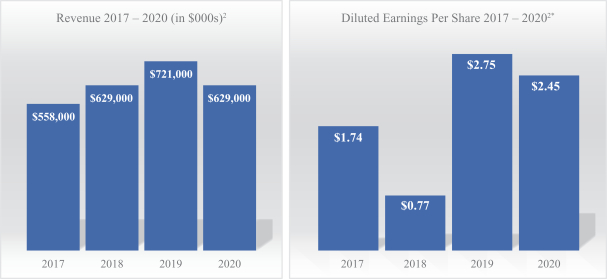

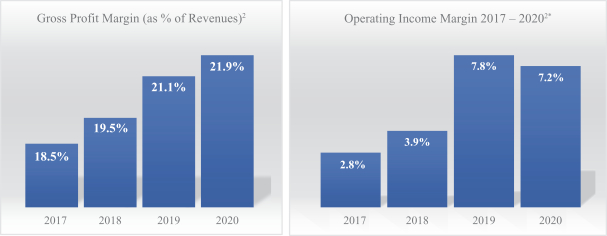

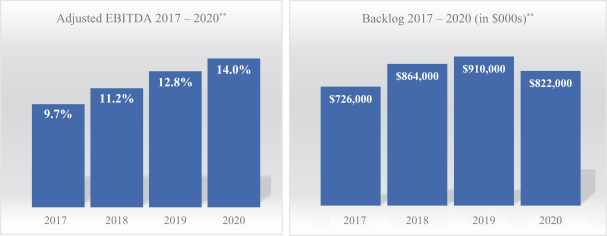

* Includes $8.8 million of restructuring charges in 2017, $14.8 million of restructuring charges in 2018 and $2.4 million in 2020.

** Adjusted EBITDA and Backlog are non-GAAP financial measures. For a discussion of these measures and for reconciliation to the nearest comparable GAAP measures, see Appendix A to this Proxy Statement.

|

Ducommun Incorporated 2021 Proxy Statement

200 Sandpointe Avenue, Suite 700

Santa Ana, California 92707-5759

(657) 335-3665

PROXY STATEMENT

We are providing you with these proxy materials in connection with the solicitation by the Board of Directors (the “Board” or “Board of Directors”) of Ducommun Incorporated of proxies to be used at our 2021 Annual Meeting of Shareholders (the “Annual Meeting”). The Annual Meeting will be held on April 21, 2021 at 9:00 a.m., Pacific Time online via live audio webcast at www.virtualshareholdermeeting.com/DCO2021. After carefully considering the format of our Annual Meeting and the ongoing public health impact of the coronavirus (“COVID-19”) and to support the health and well-being of our shareholders and employees, our Board concluded to hold the Annual Meeting exclusively online. Our goal for the Annual Meeting is to enable the largest number of shareholders to safely participate in the Annual Meeting, while providing substantially the same access and exchange with the Board and management as an in-person meeting. We believe we are observing some of the best practices for virtual shareholder meetings, including addressing as many shareholder questions as time allows. Our aim is to offer shareholders rights and participation opportunities during our virtual Annual Meeting that are comparable to those that have been provided at our past in-person annual meetings of shareholders. We intend to return to an in-person format for future shareholder meetings as soon as it is considered safe to do so. To participate in the Annual Meeting, you must go to www.virtualshareholdermeeting.com/DCO2021 and enter the 16-digit control number included in the Notice of Internet Availability of Proxy Materials, on your proxy card, or in the instructions that accompanied your proxy materials. During the Annual Meeting, shareholders may vote their shares electronically, submit questions, and examine our list of registered shareholders as of the record date by following the instructions available on the meeting website. Please refer to the “Attending the Annual Meeting” section of this Proxy Statement for more details about attending the Annual Meeting online.

This Proxy Statement contains important information regarding the Annual Meeting, the proposals on which you areis first being asked to vote, information you may find useful in determining how to vote, and information about voting procedures. As used herein, “we,” “us,” “our,” or the “Company” refers to Ducommun Incorporated, a Delaware corporation. A Notice of Internet Availability of Proxy Materials, this Proxy Statement, accompanying proxy card or voting instruction card, and our 2020 Annual Report to Shareholders will be made available to our shareholders on or about March 8, 2021. Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”) we are making our proxy materials available to our shareholders electronically via the Internet. The Notice13, 2024.

2024 Annual Meeting of Internet Availability of Proxy Materials contains instructions on how to access an electronic copy of our proxy materials, including this Proxy Statement and our 2020 Annual Report to Shareholders. The Notice also contains instructions on how to request a paper copy of the Proxy Statement. We believe this process will allow us to provide you with the information you needShareholders

| Date and Time: | Place: | Record Date: |

|  |  |

| Wednesday, April 24, 2024, at 9:00 a.m. Pacific Time | Online via live audio webcast at www.virtualshareholdermeeting.com/DCO2024 | February 26, 2024 |

Admission: To participate in a timely manner, while conserving natural resources and lowering the costs of the Annual Meeting.

At the Annual Meeting you will be askedonline, including to vote on the following proposals:

(1) Election of the one director named in this Proxy Statement to serve on the Board until the Company’s 2024 Annual Meeting and until her successor has been elected and qualified;

(2) Approve the Company’s executive compensation on an advisory basis;

|

Ducommun Incorporated 2021 Proxy Statement

(3) Ratify the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the Company’s year ending December 31, 2021; and

(4) Transact any other business as may properly come before the meeting or any adjournment thereof.

The Board of Directors recommends that you vote your shares “FOR” the election of the one director nominee named in this Proxy Statement and “FOR” each of the other proposals.

Holders of our common stock as of the close of business on February 23, 2021 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting. At the close of business on the Record Date, the Company had outstanding 11,833,064 shares of Common Stock, $.01 par value per share (the “Common Stock”). If you are a stockholder of record, there are several ways for you to vote your shares or submit your proxy:

(1) By Telephone—You can vote by telephone by calling (800) 690-6903 and following the instructions on the Notice or proxy card;

(2) By Internet—You can vote over the Internet before the Annual Meeting by visiting www.proxyvote.com by following the instructions on the Notice or proxy card;

(3) At the Annual Meeting—You can vote your shares online during the Annual Meeting, by followingshareholders will need the instructions provided16-digit control number included on their proxy card, the meeting website during the Annual Meeting;

(4) By Mail—If you received your proxy materials by mail, you can vote by mail by signing, dating and mailing the enclosed proxy card.

If your shares are held in the name of aNotice or voting instruction form, or to contact their bank, broker or other nominee you must follow(preferably at least 5 days before the instructions of your bank, broker or other nomineeAnnual Meeting) and obtain a “legal proxy” in order for your shares to be voted. Shares held beneficially may be votedable to attend, participate in, or vote at the Annual Meeting.

Meeting Agenda and Voting Matters

| Proposal | Board’s recommendation | More information | ||

| Elect three Directors to serve until the 2027 Annual Meeting | FOR each nominee | Page 8 | ||

| Approve Ducommun’s executive compensation on an advisory basis | FOR | Page 35 | ||

| Approve Ducommun’s 2024 Stock Incentive Plan | FOR | Page 70 | ||

| Ratify the selection of the independent registered public accounting firm | FOR | Page 77 |

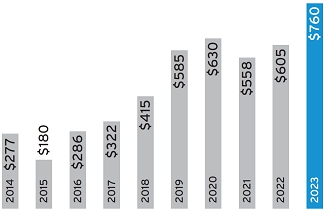

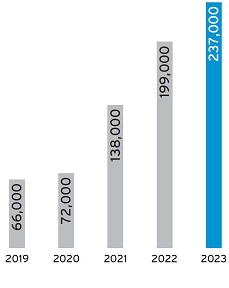

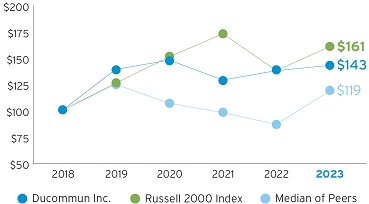

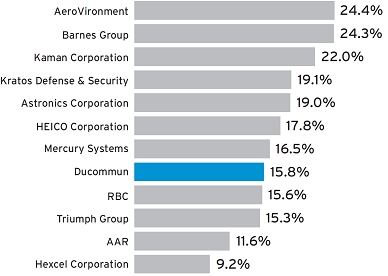

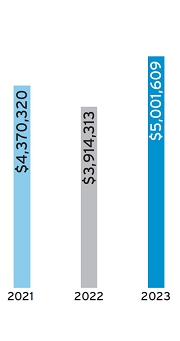

2023 Performance and Ten-Year Highlights

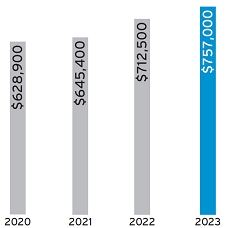

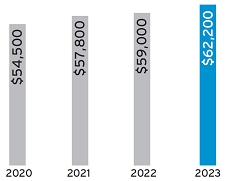

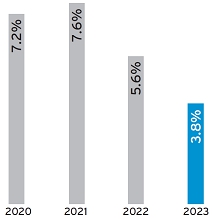

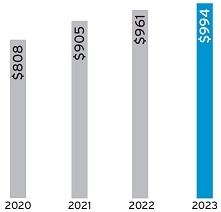

For the year ended December 31, 2023 and as we head into our 175th year, Ducommun attained more than a 25% increase in its market capitalization, all-time high revenue levels and an impressive 13% increase in gross profit over the prior year. We continued to effectively leverage many of our successes from the post-pandemic years and continued to benefit from offloading from defense primes, which we believe positions Ducommun very well moving forward. In addition, our cost actions and lean organizational structure continued to provide significant value, with our selling, general and administrative (“SG&A”) expense placing us among the lowest of our proxy talent peer group as a percentage of revenue, especially at the corporate level, and the continued implementation of a major restructuring initiative expected to accelerate the achievement of our strategic goals and objectives. 2023 also marked the sixth year since Mr. Oswald, our Chairman, President and CEO, joined the Company, and the graphs below depict the significant positive impact his leadership has had on our performance along several key metrics:

| | 2024 Proxy Statement 1 |

| 2014 - 2023 Shareholder Value by Market Capitalization (in $millions)(1) | 2014 - 2023 Net Revenue (in $millions) | |

|  | |

| 2014 - 2023 Employee Count and Net Revenue per Employee | 2014 - 2023 Gross Profit (in $millions) | |

|  | |

| 2014 - 2023 Gross Profit Margin | 2014 - 2023 Adjusted EBITDA (in $millions)(2) | |

|  |

| |2024 Proxy Statement2 |

| 2014 - 2023 Adjusted EBITDA Margins(2) | 2014 - 2023 Backlog (in $millions)(2) | |

|  |

| (1) | 2023 data based on 14,600,766 shares outstanding and closing price of $52.06 per share as of December 31, 2023. | |

| (2) | Adjusted EBITDA, Adjusted EBITDA Margins and Backlog are non-GAAP financial measures. For a discussion of these measures and for a reconciliation to the most directly comparable GAAP measures, see Appendix A to this Proxy Statement. |

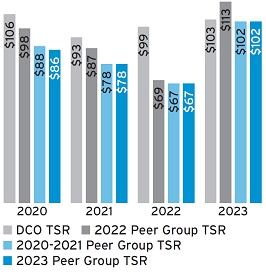

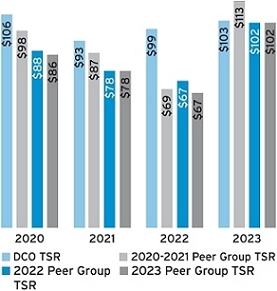

Total Shareholder Return vs. Proxy Talent Peers and Russell 2000

Comparison of 5 Year* Cumulative Total Return

Ducommun Inc. vs. Median of Peers** and Russell 2000

Assumes Initial Investment of $100 as of

December 31, 2018

| * | Data depicted in the graph is as of December 31 of each year. | |

| ** | For information about our peer group, see “Compensation Discussion and Analysis–Benchmarking and Proxy Talent Peer Group.” |

| Cumulative Total Shareholder Return as of December 31, | |||||||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | |||||||||||

| Ducommun Incorporated | $ | 139 | $ | 148 | $ | 129 | $ | 138 | $ | 143 | |||||

| Russell 2000 Index | $ | 126 | $ | 151 | $ | 173 | $ | 138 | $ | 161 | |||||

| Median of Proxy Talent Peers | $ | 125 | $ | 107 | $ | 98 | $ | 87 | $ | 119 | |||||

Our relative total shareholder return compared to the Russell 2000 Index over the 3-year period between 2021 and 2023 was in the 50th percentile, ranking 859th out of 1,720 companies.(3)

| (3) | “Final Payout Determination for Performance Shares Granted in 2021,” Willis Towers Watson, January 19, 2024. |

| |2024 Proxy Statement3 |

Information About the Board of Directors

| Director | Age | Gender | Under- represented | Principal Occupation | Director Since | Term Expires | Independent? | Committees | ||||||||

| Nominees for election at the 2024 Annual Meeting | ||||||||||||||||

| Shirley G. Drazba | 66 | F | N | Former Corporate Vice President, Product Line Strategy and Innovation, IDEX Corporation | 2018 | 2024 | Yes | Comp Innovation (chair) | ||||||||

| Sheila G. Kramer | 64 | F | N | Chief Human Resources Officer, Donaldson Company, Inc. | 2021 | 2024 | Yes | Comp G&N | ||||||||

| David B. Carter | 66 | M | N | Former Senior Vice President, Engineering, Pratt & Whitney Company, Inc. | 2024* | 2024 | Yes | Innovation | ||||||||

| Continuing Directors | ||||||||||||||||

| Richard A. Baldridge | 65 | M | Y | Vice Chairman, Viasat, Inc. (Ret.) | 2013 | 2026 | Yes | Audit Innovation | ||||||||

| Robert C. Ducommun | 72 | M | N | Business Advisor | 1985 | 2025 | Yes | Audit G&N (chair) | ||||||||

| Dean M. Flatt Independent Lead Director | 73 | M | N | Former President, Defense & Space, Honeywell International | 2009 | 2025 | Yes | Comp (chair) G&N | ||||||||

| Stephen G. Oswald | 60 | M | N | Chairman, President and Chief Executive Officer, Ducommun Incorporated | 2017 | 2026 | No | Innovation | ||||||||

| Samara A. Strycker | 52 | F | N | Senior Vice President, Corporate Controller and Treasurer, Navistar International Corporation | 2021 | 2026 | Yes | Audit (chair) | ||||||||

| * | Mr. Carter was elected as a Class 2025 Director by the Board effective February 1, 2024. On March 11, 2024, Mr. Carter tendered his resignation as a Class 2025 Director, subject to and effective upon his election as a Class 2027 Director at the Annual Meeting. See “Proposal 1 – Election of Directors” for additional information regarding the proposed change to Mr. Carter’s Director class. |

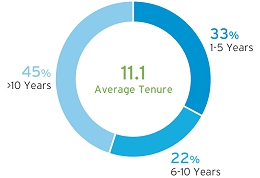

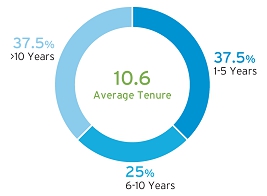

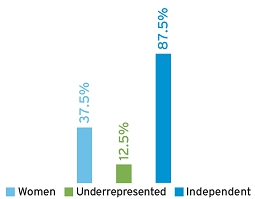

Ducommun is very proud that women and an individual from an underrepresented background collectively comprise over 40% of our Board of Directors (the “Board”), and will collectively comprise 50% of our Board immediately following the election of directors at the Annual Meeting only if you obtain a legal proxy fromafter the broker or nominee giving you the right to vote the shares.

If you vote by proxy, the individuals named on the proxy card will vote your sharesretirement of Mr. Jay Haberland. The tenure of our directors, our Board’s overall gender and racial diversity and its independence are summarized in the manner you indicate. Each shareholder may appoint only one proxy holder or representative to attendgraphs below.

| Directors’ Tenure (Pre-Annual Meeting) | Director Diversity & Independence (%) (Pre-Annual Meeting) | |

|  | |

| |2024 Proxy Statement4 |

| Directors’ Tenure (Post-Annual Meeting) | Director Diversity & Independence (%) (Post-Annual Meeting) | |

|  |

Corporate Governance Highlights

| • | Stringent stock ownership guidelines for directors and executive officers |

| • | Lead Independent Director with significant authority and responsibilities |

| • | All committees except the Innovation Committee are made up entirely of independent directors |

| • | The Board and each Board committee conducts an annual self-evaluation |

| • | All directors attended 100% of all Board and applicable committee meetings during 2023 |

| • | Board-level oversight of Corporate and Environmental Responsibility and cybersecurity programs |

| • | Regular shareholder engagement activities |

| • | Amended and Restated Clawback Policy applies to all incentive-based compensation in compliance with Rule 10D-1 under the Securities and Exchange Act of 1934 |

| • | Company-wide prohibition on hedging or pledging Ducommun securities |

| • | Annual advisory vote on executive compensation |

| • | Confidential ethics hotline available 24/7 by telephone or internet |

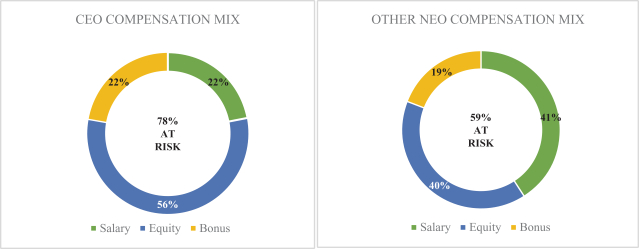

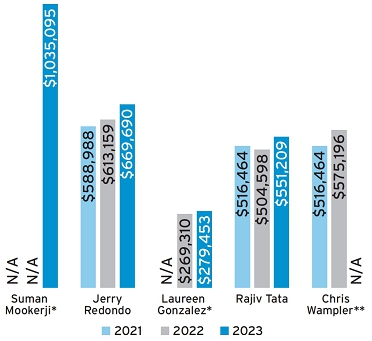

Executive Compensation Highlights

Our executive compensation program is oriented towards a pay-for-performance approach. In 2023, performance-based compensation represented a significant percentage of the Annual Meeting on his or her behalf. In the election of directors, holders of Common Stock have cumulative voting rights. Cumulative voting rights entitle a shareholder to a number of votes equal to the number of directors to be elected multiplied by the number of shares held. The votes so determined may be casttotal target compensation for one candidate or distributed among one or more candidates. Votes may not be cast, however, for a greater number of candidates than the number of nominees named herein. On all other matters to come before the Annual Meeting, each holder of Common Stock will be entitled to one vote for each share owned, and you may specify whether your shares should be voted for or against each of the other proposals.named executive officers.

If you submit a proxy without indicating your instructions, your shares will be voted as follows: (1) “FOR”

2023 Target Pay Mix*

| CEO Target Compensation Mix | Other NEO Target Compensation Mix | |

|  | |

| * | “Long-Term Incentives” includes the grant date closing price value of both equity and performance-based long-term incentive cash awards in 2023. Please also note that we do not offer any type of pension plan for our CEO or NEOs. |

| |2024 Proxy Statement5 |

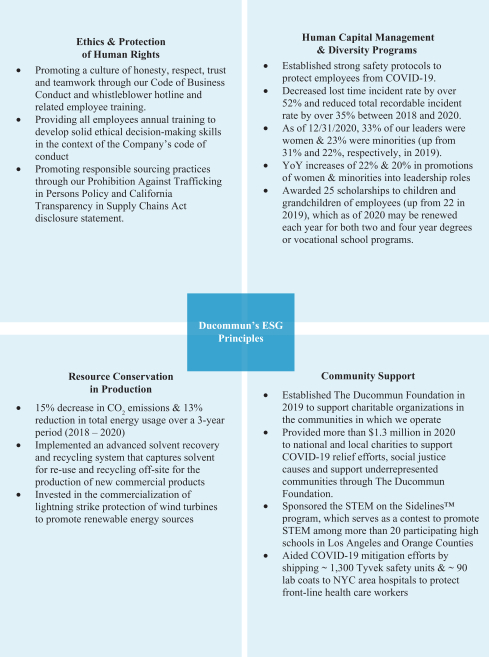

Environmental and Safety Highlights

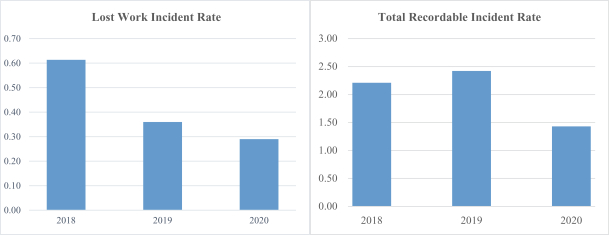

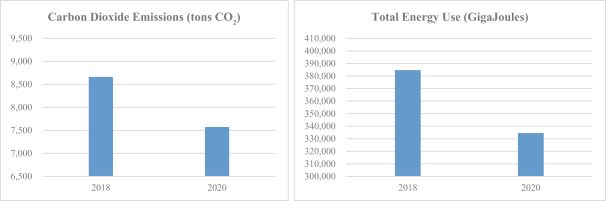

Over the election of the one director named in the Proxy Statement to serve on the Board until the Company’s 2024 Annual Meeting of Shareholdersfour-year period between January 1, 2019, and until her successor has been elected and qualified, (2) “FOR” approval of the Company’s executive compensation on an advisory basis, (3) “FOR” the ratification of the selection of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2021,2023, Ducommun’s lost time incident rate(4) dropped to zero, which was a remarkable achievement, and (4)our total recordable incident rate(5) decreased by approximately 75%:

Between 2019 and 2023, there was an impressive 34% decrease in their discretion on such other business as may properly come before the Annual Meeting or any adjournment thereof. Any shareholder may revoke his or her proxy at any time prior to its use by (1) sending a written revocation to the Corporate Secretary, (2) submitting a later dated proxy, or (3) voting over the internet during the virtual Annual Meeting.

In order to conduct business at the Annual Meeting, a “quorum” must be established. A quorum is a majorityour combined Scope 1 and 2 greenhouse gas emissions, and an approximately 16% reduction in voting power of the outstanding shares of Common Stock entitled to vote at the Annual Meeting. Shares of Common Stock that reflect both abstentions and broker non-votes will be treated as present and entitled to vote for the purposes of establishing a quorum. “Broker non-votes” are shares held by a broker, bank or other nominee with respect to which the holder of record does not have discretionary power to vote on a particular proposal and with respect to which instructions were never received from the beneficial owner. Shares that constitute broker non-votes with respect to a particular proposal will not be considered present and entitled to vote on that proposal at the Annual Meeting even though the same shares will be considered presentDucommun’s total energy usage:

| (4) | Lost time incidents are defined as incidents that resulted in days away from work. This measure is similar to the days away, restricted or transferred metric utilized by the Occupational Safety and Health Administration. The annual lost time incident rate is calculated by dividing the total number of lost time injuries in a year by the total number of hours worked in a year. | ||||

| (5) | The total recordable incident rate is calculated by multiplying the annual number of OSHA Recordable Cases by 200,000, and dividing the product by the total hours worked by all employees during the year. The number 200,000 is used in the calculation to represent the number of hours worked in a year by 100 employees working 40 hours per week over 50 weeks, which provides the basis for calculating the incident rate for the entire year. |

| |2024 Proxy Statement6 |

Important Note Regarding Forward-Looking Statements and Website References

Ducommun Incorporated 2021This Proxy Statement

for purposes of establishing a quorum and may be entitled to vote on other proposals. However, in certain circumstances, such as includes forward-looking statements within the appointmentmeaning of the independent registered public accounting firm,Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts, including statements regarding the broker, bank or other nominee has discretionary authorityfuture results of our operations, expected benefits of our restructuring plan, and therefore, is permitted to vote your shares even if the broker, bank or other nominee does not receive voting instructionsour corporate responsibility, including our Corporate Environmental Responsibility (“CER”) Program, sustainability, employees, environmental matters, policy, procurement, philanthropy, data privacy and cybersecurity, and business risks and opportunities, as well as statements from you.

Agenda items relating to the election of directorsthird parties about our CER performance and the approval of the Company’s executive compensation on an advisory basis are not considered “routine” matters and as a result, your broker, bank or other nominee will not have discretion to vote on these matters at the Annual Meeting unless you provide applicable instructions to do so. Therefore, we strongly encourage you to follow the voting instructions on the materials you receive.

In the election of directors, the candidate receiving the highest number of votes will be elected. Abstentions and broker non-votes will have no effect on director elections. For all other proposals to be approved, the proposal must receive the affirmative vote of a majority of the shares of Common Stock present or represented by proxy and entitled to vote on the proposal. Abstentions will have the effect as a vote against Proposals 2, and 3, whereas broker non-votes will not affect the outcome of Proposal 2.

We intend to solicit proxies by mail, telephone, facsimile, and internet. D. F. King & Co., Inc. has been retained to assistrisk profile made in the solicitation of proxies for which it will be paid a fee of approximately $7,500 plus reimbursement of out-of-pocket expenses. Brokers, nominees, banks, and other custodians will be reimbursed for their costs incurred in forwarding solicitation material to beneficial owners. All expenses incident to the proxy solicitation will be paid by the Company.

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to be Held on April 21, 2021.

The Notice of Annual Meeting, this Proxy Statement are forward-looking. We use words such as anticipates, believes, expects, future, intends, and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Forward-looking statements are not guarantees or promises that goals or targets will be met. Actual results could differ materially for a variety of reasons. In addition, historical, current, and forward-looking sustainability-related statements may be based on current or historical goals, targets, aspirations, commitments, or estimates; standards for measuring progress that are still developing; diligence, internal controls, and processes that continue to evolve; data, certifications, or representations provided or reviewed by third parties, including information from acquired entities that is incomplete or subject to ongoing review or has not yet been integrated into our reporting processes; and assumptions that are subject to change in the future. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our 2023 Annual Report on Form 10-K under the heading “Risk Factors”. Website references throughout this Proxy Statement are provided for convenience only, and the 2020 Annual Report to Shareholders are

available at

http://materials.proxyvote.com/264147.

content on the referenced websites is not incorporated by reference into this document.

| | 2024 Proxy Statement 7 |

|

Ducommun Incorporated 2021 Proxy Statement

| Back to Contents |

Proposal 1

Election of Directors

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board is divided into three classes, with one class elected at each annual meeting of shareholders. Directors of each class are elected to serve for three yearthree-year terms. Pursuant to the Company’s Bylaws, the Board is authorized to fix by resolution from time to time the size of the Board, provided that the Board is no greater than nine and no less than six directors. The Board has by resolution fixed the size of the Board at sevennine directors effective until effective immediately prior to the election of directors at the Annual Meeting, at which time the Board has fixed the size of the Board at sixeight directors.

At

Three directors (out of a total of eight) are to be elected at the Annual Meeting the Company will elect the one director named in this Proxy Statement to serve for a three-year term ending at the Annual Meeting of Shareholders in 2024. The director nominee for such position is Shirley G. Drazba. Gregory S. Churchill, one2027 and the election and qualification of our existing Class 2021their respective successors. In accordance with the Company’s Corporate Governance Guidelines, directors will generally not be standingnominated for re-electionelection after attaining the age of 73, and accordingly, Mr. Jay Haberland will be retiring from the Board upon the election of directors at the Annual Meeting. On behalf of theThe Board is most grateful to and management, the Company thanks Mr. ChurchillHaberland for his many15 years of invaluable leadership, guidanceservice.

In light of Mr. Haberland’s retirement, our Board class requirements under our Certificate of Incorporation, the vacancy that will emerge in our Class of 2027 Directors and contributions.other factors, on March 11, 2024, our Board, upon the recommendation of our Corporate Governance and Nominating Committee, determined that it was advisable to nominate Mr. David Carter to stand for election as a Class of 2027 Director at the Annual Meeting, subject to Mr. Carter agreeing to resign as a Class 2025 Director and subject to and effective upon his election as a Class 2027 Director at the Annual Meeting, which resignation Mr. Carter agreed to on March 11, 2024. Accordingly, at the Annual Meeting, shareholders will be asked to elect each of Ms. Drazba, Ms. Kramer and Mr. Carter to serve for a three-year term ending at the Annual Meeting of Shareholders in 2027 and until their respective successors have been duly elected and qualified, subject to their earlier death, resignation, or removal. Having Mr. Carter stand for election at the Annual Meeting also provides our shareholders with the opportunity to vote upon our newest Board member.

In the absence of a contrary direction, proxies in the accompanying form will be voted for the election of Ms. Drazba.Drazba, Ms. Kramer and Mr. Carter. If Ms. Drazba isany nominee becomes unable or unwilling to serve as a nomineedirector at the time of the Annual Meeting, the individuals named as proxies may vote for a substitute nominee chosen by the present Board to fill the vacancy. Alternatively, the Board may reduce the size of the Board. However, weits size. We have no reason to believe that Ms. Drazba, Ms. Kramer or Mr. Carter will be unwilling or unable to serve for the stated term if elected as a director.directors. In the event that any personanyone other than the nominee named herein should beDucommun’s three nominees is nominated for election as a director, the proxy holders mayare not required to vote for less than all of the nominees and in their discretion may cumulate votes.THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF MS. DRAZBA TO THE BOARD OF DIRECTORS.

| THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF MS. DRAZBA, MS. KRAMER AND MR. CARTER AS CLASS OF 2027 DIRECTORS. |

| | 2024 Proxy Statement 8 |

Corporate Governance

Directors’ QualificationsSkills and Diversity

The Board of Directors believes that the Board, as a whole,its members should possess a combination of skills, professional experience, and diversity of backgrounds necessary to oversee our management and support the interests of our shareholders. In addition, the Board believes that there are certain attributes that every director should possess, as presentedhas outlined in our Corporate Governance Guidelines.Guidelines certain attributes it believes every director should possess. Accordingly, the Board and its Corporate Governance and Nominating Committee consider the qualifications of directors and director candidates both individually and in the broader context of the Board’s overall composition and our current and future needs.

The Corporate Governance and Nominating Committee is responsible for developing and recommending director membership criteria to the Board for approval. The current criteria which are presented in our Corporate Governance Guidelines, include independent and sound judgment, integrity, the ability to commit sufficient time and attention to Board activities, and the absence of potential conflicts with our interests. In addition, the Corporate Governance and Nominating Committee periodically evaluates the composition of the Board to assess the skills, experience and perspectives that are currently represented, on the Board as well asand to determine which of those the Board believesattributes will be valuable in the future given our current state and strategic plans.

direction. As part of this periodic assessment, the Corporate Governance and Nominating Committee also evaluates the effectiveness of the overall Board dynamic. dynamic, including our initiatives related to Board diversity.

While we do not have a formal policy on boardBoard diversity, the Company’s recently revisedDucommun’s Corporate Governance Guidelines reflect the Board’s belief that a blend of different professional experiences and personal perspectives contributescontribute to the quality of the Board’s oversight and is anare essential componentenablers of effective governance. We thereforeWith that, we are committed to assuringthe belief that the Board’sBoard diversity is not reflected not justsolely in the variety of theour directors’ professional backgrounds and experiences, but also inexperiences. We believe that the quality of our deliberations and decisions, and of our overall governance, is enhanced by the perspectives represented by directors ofwith different personal characteristics, theirparticularly, gender, race, cultural heritage and age in particular.age. As a result, of such an assessment, in 2018 the Board recognized that additional expertise in the: (i) development and execution of technology based product and market strategies, and (ii) creation and deployment of innovative development, fabrication and management processes, would add to the effectiveness of the overall Board dynamic. Thereafter, the Corporate Governance and Nominating Committee has been deliberate in striving to achieve a broad range of diversity in the pools from which qualified director candidates are selected, as it has worked over the past few years to identify successors to a group of very capable directors. Over that time and with the assistance of Spencer Stuart, an outsideindependent executive search firm, Spencer Stuart,the Corporate Governance and Nominating Committee successfully identified Ms.and engaged Mmes. Drazba, Kramer and Strycker, and more recently, Mr. Carter, each from within a competitive poolpools of candidates, and recommended to the Board that shethey each be appointed as directors. We are very proud that women and a director.

|

Ducommun Incorporated 2021 Proxy Statement

member from an underrepresented background currently comprise over 40% of our Board, and will collectively comprise 50% of our Board immediately following the election of directors at the Annual Meeting.

The Corporate Governance and Nominating Committee supports the Board’s commitment to engaging a diverse field of director candidates. As Board seats become available, the Corporate Governance and Nominating Committee will continue to actively identify qualified women and individuals from underrepresented communities to include in the pool from which Board nominees are chosen. The Corporate Governance and Nominating Committee is confident that with this commitment will contribute to better representation and higher visibility for individuals with diverse perspectives and personal characteristics will have significantly better representation and visibility within the pool of director candidates from which future Board members will be selected and nominated.characteristics.

| | 2024 Proxy Statement 9 |

In evaluating director candidates and considering incumbent directors for re-nomination to the Board, the Corporate Governance and Nominating Committee has consideredreviewed a variety of factors. These includefactors, including each nominee’s independence, financial literacy, personal and professional accomplishments, and experience. Below is a matrix of the skills represented by our Board’s skills:director nominees and continuing directors.

| Oswald | Baldridge | Churchill | Drazba | Ducommun | Flatt | Haberland | ||||||||

Senior Leadership | X | X | X | X | X | X | X | |||||||

Global/International | X | X | X | X | X | X | ||||||||

Financial | X | X | X | X | ||||||||||

Aerospace & Defense Industry | X | X | X | X | X | X | X | |||||||

Manufacturing | X | X | X | X | X | X | ||||||||

Technology | X | X | X | X | X | |||||||||

Strategy, Business Development and M&A | X | X | X | X | X | X | X | |||||||

Product Marketing / Innovation | X | X | X | X | ||||||||||

Cybersecurity / Information Security | X | X | X | X | ||||||||||

Human Capital | X | X | X | X | X | |||||||||

Public Company Board | X | X | X | |||||||||||

Independent | X | X | X | X | X | X | ||||||||

Gender Diversity | X | |||||||||||||

Racial Diversity | X | |||||||||||||

Years on Board | 4 | 8 | 8 | 3 | 36 | 12 | 12 | |||||||

| Oswald | Baldridge | Carter | Drazba | Ducommun | Flatt | Kramer | Strycker | |

| Senior Leadership Significant experience leading organizations, developing business strategies and talent |  |  |  |  |  |  |  |  |

| Global/International Global business and international experience necessary for expanding the footprint of the organization |  |  |  |  |  |  |  | |

| Financial Expertise with complex financial transactions and optimizing capital structures |  |  |  |  | ||||

| Aerospace & Defense Industry Industry experience that provides insight on issues unique to the A&D industry |  |  |  |  |  |  |  | |

| Manufacturing Experience managing the operations of a complex A&D business |  |  |  |  |  |  |  | |

| Technology Experience identifying technological advances that may affect our business |  |  |  |  |  | |||

| Strategy, Business Development and M&A Experience with identifying M&A targets that will advance strategic objectives |  |  |  |  |  |  | ||

| Product Marketing/Innovation Experience in new product development and growing market share |  |  |  |  | ||||

| Cybersecurity/Information Security Experience with successfully implementing and overseeing measures to prevent data breaches |  |  |  |  | ||||

| Human Capital Expertise in compensation design and managing human capital issues |  |  |  |  |  |  | ||

| Sustainability Experience in the areas of environmental impact, corporate responsibility or sustainability strategies |  |  |  |  | ||||

| Public Company Board Understanding of the extensive and complex oversight responsibilities of public company boards to protect the interests of shareholders based on experience serving on other public company boards |  |  |

| |2024 Proxy Statement10 |

Directors’ Backgrounds and Qualifications

The following information is furnished as of February 23, 2021,March 13, 2024, with respect to each person who is a nominee for election to the Board, as well as our other five directors whose terms of office will continue after the Annual Meeting.

|

|

|

| |||

|

| |||||

| ||||||

Nominees For Election

|

Ducommun Incorporated 2021 Proxy Statement

|  |

|

|

| ||

|

| |||||

| ||||||

|

|

|

| |||

DRAZBA Corporate Vice President, Product Line Strategy & Innovation, IDEX Corporation (Ret.)

Age: 66 Director Since: 2018 Term Expires: 2024 Committees: • Compensation and Innovation (Chair) | Professional background Ms. Drazba served as Corporate Vice President, Product Line Strategy & Innovation for IDEX Corporation, which designs, manufactures and markets a range of pump products, dispensing equipment, and other engineered products, Key qualifications As a long-time executive responsible for product strategy, innovation, and commercial excellence, Ms. Drazba contributes to the Board extensive experience in creating high value | |||||

portfolios. |

| ||||||

SHEILA G. KRAMER Chief Human Resources Officer, Donaldson Company, Inc.

Director Since: 2021 Term Expires: 2024 Committees: • Corporate Governance & Nominating and Compensation | Professional background Ms. Kramer has been the Chief Human Resources Officer of Donaldson Company, Inc., a provider of engine and industrial filtration solutions, since January 2020. Ms. Kramer joined Donaldson Company, Inc. in October 2015 as its Vice President, Human Resources. From 2013 to 2015, Ms. Kramer was Vice President, Human Resources of Taylor Corporation, a premier provider of interactive printing and marketing solutions to more than half of Fortune 500 companies. Before joining Taylor Corporation, Ms. Kramer spent approximately 22 years in various leadership roles at Lifetouch, Inc. one of the world’s largest employee-owned photography companies. Key qualifications As the current Chief Human Resources Officer of Donaldson Company, Inc., Ms. Kramer contributes to the Board extensive senior leadership experience as well as direction on human capital issues pertinent to Ducommun’s C&ER program. |

| DAVID B. CARTER Senior Vice President, Engineering, Pratt & Whitney Company, Inc. (Ret.) Age: Director Since: 2024 Term Expires: 2024 Committee: • Innovation | Professional background Mr. Carter is the retired Senior Vice President of Engineering, Pratt & Whitney Company, Inc., an aerospace manufacturer that is a subsidiary of Raytheon Technologies Corporation, a position he occupied for four years until his retirement in 2019. Mr. Carter was previously the Senior Vice President, Engineering, Operations and Quality at UTC Aerospace Systems from 2015 to 2016 and served as its Vice President, Engineering and Technology from 2012 to 2015. Key qualifications As former Senior Vice President, Engineering at Pratt & Whitney, Mr. Carter brings to the Board his experience in all aspects of technology development, product design and certification, and an understanding of the defense markets that Ducommun serves. |

| |2024 Proxy Statement11 |

Continuing Directors

| RICHARD A. BALDRIDGE Vice Chairman, Viasat, Inc. (Ret.) Age: 65 Director Since: Term Expires: Committees: • Audit and Innovation | Professional background Mr. Baldridge served as Vice Chairman of Viasat, Inc., a global communications company, from July 2022 until his retirement in June 2023. Mr. Baldridge joined Viasat in 1999, serving as Executive Vice President, Chief Financial Officer and Chief Operating Officer from 2000, as Executive Vice President and Chief Operating Officer from 2002, as President and Chief Operating Officer from 2003, and as President and Chief Executive Officer from November 2020 until June 2022. In July 2022, Mr. Baldridge was appointed Vice Chairman of Viasat until his retirement in June 2023. Before joining Viasat, Mr. Baldridge was Vice President and General Manager of Raytheon Corporation’s Training Systems Division, and he held executive roles with Hughes Information Systems and Hughes Training Inc. before they were acquired by Raytheon in 1997. Mr. Baldridge is also a director of EvoNexus, a non-profit business incubator. Key qualifications Other public company directorships Viasat (since 2016) |

| ROBERT C. DUCOMMUN Business Advisor Age: 72 Director Since: 1985 Term Expires: 2025 Committees: •Audit and Corporate Governance & Nominating (Chair) | |

| Professional background Mr. Ducommun Key qualifications As a former management consultant and Chief Financial Officer, Mr. Ducommun brings to the Board substantial financial acumen and leadership in setting the strategic direction for the Company, | |

|

| ||||

|

Ducommun Incorporated 2021 Proxy Statement

STEPHEN G. OSWALD

Chairman, President and Chief Executive Officer

Age: 60

Term Expires: 2026 Committee: • Innovation | Professional background

|

Key qualifications As Chairman, President and Chief Executive Officer, Mr. Oswald provides management’s perspective in Board discussions about Ducommun’s business and strategic direction. |

| |2024 Proxy Statement12 |

| DEAN M. FLATT President, Defense & Space, Honeywell International, Inc. (Ret.) Age: 73 Director Since: 2009

|

Term Expires: 2025 Committees: •Corporate Governance & Nominating and Compensation (Chair) | |

| Professional background Mr. Flatt is the retired President, Defense & Space of Honeywell International, Inc. Key qualifications As the former President of several divisions of one of the world’s largest avionics manufacturers, Mr. Flatt contributes to the Board diverse operational experience and understanding of technologies relevant to the Company’s business. | ||

Curtiss-Wright Company (since 2012) |

| ||||||

SAMARA A. STRYCKER Senior Vice President, Corporate Controller and Treasurer, Navistar International Corporation

Director Since: 2021 Term Expires: 2026 Committee: • Audit (Chair) | Professional background

|

|

| |||

As Senior Vice President,

|

| |||||

expertise. | ||||||

|

Ducommun Incorporated 2021 Proxy Statement

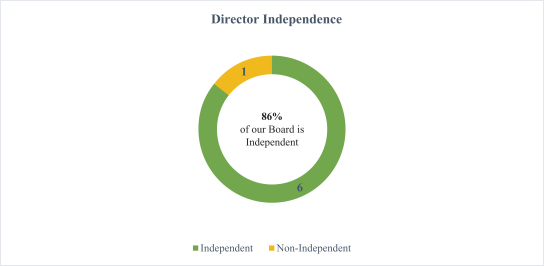

Director Independence

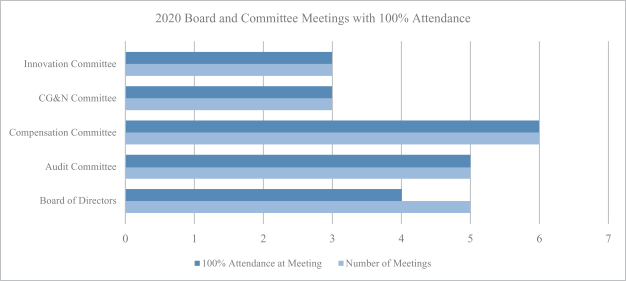

The Board met five times in 2020. All directors attended over ninety percent (90%) of all Board meetingsOur Corporate Governance Guidelines provide that a majority, and committee meetingspreferably at least two-thirds, of the Board of which they were members during 2020. We strongly encourage all directors to attend the Annual Meeting of Shareholders, and all eight of the directors at the time attended the 2020 Annual Meeting of Shareholders. We have a policy of holding regularly scheduled executive sessions of non-management directors following each regularly scheduled meeting of the full Board. Additional executive sessions of non-management directors maymust be held from time to time as required.independent. The director currently serving as the presiding director during executive sessions is Mr. Flatt, the Lead Independent Director of the Board. The graphic below depicts the attendance of directors at Board and committee meetings held in 2020:

As illustrated below, the Board has determined that each of Ms.Mmes. Drazba, Kramer and Strycker, as well as Messrs. Baldridge, Churchill,Carter, Ducommun, Flatt, and Haberland qualify as independent directors under the independence standards ofas defined in the New York Stock Exchange’s (“NYSE”) listing standards and that Mr. Robert Paulson qualified as an independent director under NYSE listing standards during the period he served on the Board until his retirement in May 2020.

standards.

| |2024 Proxy Statement13 |

|

Ducommun Incorporated 2021 Proxy Statement

| Back to Contents |

Board Leadership Structure

Description of Director Compensation

Due to the various challenges facing the Company, our employees and our customers during the COVID-19 pandemic, directors who are not employees of the Company or a subsidiary voluntarily reduced the value of stock-based compensation to which they were entitled in 2020 from $100,000 to approximately $64,100. In addition, directors are paid an annual retainer and a fixed fee for each meeting of a committee of which they are a member and/or a chair as follows:

Board Retainer | Committee Chair Cash Retainer | Lead Director Cash Retainer | Committee Cash Meeting Fee | |||||||||||||||||||||

Cash | Stock-Based(1) | Audit | Compensation | Innovation | Corp. Gov. | |||||||||||||||||||

$70,000 | $64,100 | $17,500 | $12,500 | $7,500 | $7,500 | $30,000 | $2,000 | |||||||||||||||||

• Dean M. Flatt serves as the • 8 of our • All of the |

Under the Directors Deferred Incomethe Board’s Audit, Compensation and Retirement Plan, which was updated in 2010, a director may elect to defer payment of all or part of his or her fees for service as a director until the director retires from service on the Board. Deferred directors’ fees may be notionally invested, at the election of the director, in a fixed interest account or a phantom stock account that tracks our Common Stock with dividends (if any), and will be paid with earnings thereon following the retirement of the director. Upon retirement from the Board, Mr. Ducommun will receive an annual retainer fee of $25,000, which was in effect in 2009, for life or for a period of years equal to his service as a director prior to 1997 (when the accrual of additional years of service was terminated), whichever is shorter, provided that he retires after the age of 65, and is not an employee of the Company when he retires.

2020 Director Compensation Table

The following table presents the compensation earned or paid by the Company to the non-employee directors for the year ended December 31, 2020.

| Fees Earned or Paid in Cash ($) | Stock Awards ($)(1)(2)(3) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($)(4) | Total ($) | |||||||||||||

Richard A. Baldridge | 92,000 | 64,100 | — | 156,100 | ||||||||||||

Gregory S. Churchill | 89,500 | 64,100 | — | 153,600 | ||||||||||||

Shirley G. Drazba | 86,000 | 64,100 | — | 150,100 | ||||||||||||

Robert C. Ducommun | 99,500 | 64,100 | 1,010 | 164,610 | ||||||||||||

Dean M. Flatt | 113,500 | 64,100 | — | 177,600 | ||||||||||||

Jay L. Haberland | 113,500 | 64,100 | — | 177,600 | ||||||||||||

Robert D. Paulson | 58,000 | — | — | 58,000 | ||||||||||||

|

|

|

Ducommun Incorporated 2021 Proxy Statement

|

|

Director Stock Ownership Policy

The Board has adopted, and recently updated, a stock ownership requirement covering all non-employee directors. Under the revised policy, non-employee directors must acquire and hold shares of our common stock equal in value to at least five times the annual Board cash retainer paid to all non-employee directors. Non-employee directors are expected to meet the holding requirements of the updated stock ownership guidelines by December 31st of the fifth year following their initial election to the Board. Under the updated guidelines, a non-employee director’s stock ownership is valued based on the average trading price of our stock over a twelve-month period ending on December 31st of each calendar year. All directors are in compliance or have additional time in which to comply with the updated stock ownership guidelines.

Our Bylaws provide the Board with the discretion to elect a Chairman who may or may not be one of our officers. This providesflexibility enables the Board with flexibility to decide what leadership structure is in our best interests at any point in time and thegiven time. The Board periodically reviews theits structure of Board and our leadership as part of theits succession planning process. Below is an overview of our Board leadership structure:

| ||||

At our 2018 Annual Meeting, the Board appointed Mr. Oswald to the position of Chairman, and Mr. Oswald has served as Chairman since held both the Chairman and Chief Executive Officer (“CEO”) roles. our 2018 annual meeting.

The independent members of the Board have determined that, at this time, having the same person serve as Chairman and CEO provides us with a morean efficient leadership structure when combined with an active lead independent director as such a structurebecause it allows the Board to benefit from the CEO’s extensive knowledge of our business and strategy, promotes alignment between the Board and management on corporate strategy, facilitates management’s effective execution of that strategy, facilitates communications and relations with other members of senior leadership, and also bolsters the quality of our governance. In the future, however, the roles of Chairman and CEO may be filled by the same or different individuals.

|

Ducommun Incorporated 2021 Proxy Statement

The Board also believes that strong, independent leadership and oversight of management is an important component of an effective Board. To that end, the Board hasindependent directors have elected Dean M. Flatt as the Lead Independent Director with significant leadership authority and responsibilities, including those as set forth below:below.

| Board Matter | Responsibility | |

| Agendas |

|

| • Provides input on and approves the Board agenda. • Approves schedules for Board meetings. | |

Board Meetings | • Presides at Board meetings at which the Chairman and CEO is not present, including regularly scheduled executive sessions of the independent directors held after regular meetings of the Board. | |

Executive Sessions |

Has authority to call executive sessions of the independent directors. • Sets the agenda for and leads non-management and independent director sessions held by the Board. • Briefs the Chairman and CEO on any issues arising from non-management and independent director sessions. | |

Communications with Directors | • Coordinates the activities of the independent • Advises on the flow of information sent to the

Board. | |

Communications with Shareholders |

Is available for consultation and communication with major shareholders as appropriate. | |

| |2024 Proxy Statement14 |

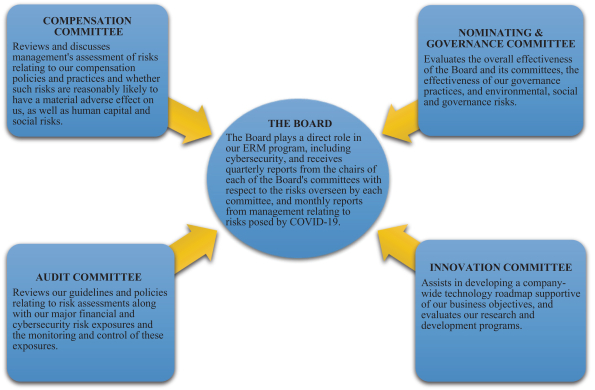

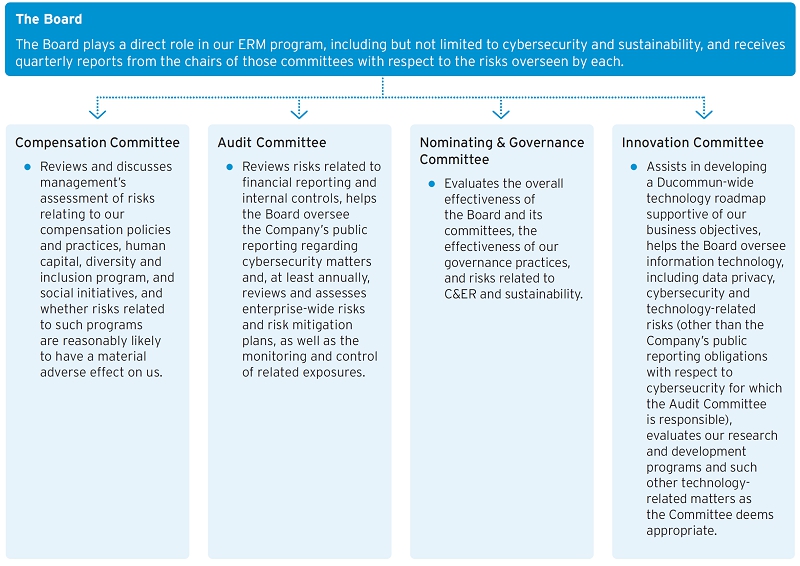

THE BOARD’S ROLE IN RISK OVERSIGHTThe Board’s Role in Risk Oversight

The Board of Directors oversees risk management as a wholeboth collectively and through its Committees.individual committees. The Board regularly reviews information regarding, and risks associated with, our operations, liquidity, cybersecurity, and environmental, socialCorporate and governanceEnvironmental Responsibility (“ESG”C&ER”) issues. In addition, in 2020, the Board received monthly updates from management relating to risks related to COVID-19program and measures implemented to protect the health and safety of employees and maintain supply chains, and was thereforeis highly engaged with management in identifying and overseeing such measures. Moreover, the scopematters.

As part of the Board’s oversight regarding COVID-19 spanned,role in overseeing the Company’s enterprise risk management (“ERM”) program, it devotes time and continuesattention to span,cybersecurity and data privacy related risks in conjunction with the Innovation Committee. The Board and the aforementioned committee receive reports on cybersecurity, data privacy and technology-related risk exposures from management, including our head of Information Technology (“IT”) and security, at least once a broad range of matters,year and more frequently as applicable.

We have an enterprise-wide approach to addressing cybersecurity risk, including protecting the healthinput and safetyparticipation from management and support from our IT Steering Committee that is composed of our employees, evaluatingSenior Vice President Electronic and Structural Systems, Chief Financial Officer, General Counsel, Chief Human Resources Officer, Vice President Supply Chain Management, and Chief Information Security Officer (Head of IT and Cybersecurity). Our cybersecurity risk management program leverages the impactNational Institute of Standards and Technology Framework which is augmented with Cybersecurity Maturity Model Certification components to meet our particular needs. We regularly assess the pandemicthreat landscape and take a holistic view of cybersecurity risks, with a layered cybersecurity strategy based on strategy, operations, capital allocation, liquidityprotection, detection, and financial matters, succession planning matters, interruptions in supply chains and financial markets, and monitoring continued compliance with applicable laws.mitigation. Our IT security team, which is composed of internal resources, reviews enterprise risk management-level cybersecurity risks at least annually.

While the full Board has the ultimate oversight responsibility for the risk management process, various Board Committeescommittees also have responsibilities for risk management inoversight responsibilities over certain substantive areas. In particular,The Board believes that its programs for overseeing risk, as described below, would be effective under a variety of leadership frameworks. Accordingly, the Audit Committee reviews risks related to financial reporting and internal controls. The Audit Committee also, at least annually, reviews and assesses enterprise-wide risks and risk mitigation plans implemented by management. Management regularly reports on each such risk to the Audit Committee or the full Board, as appropriate, and additional review or reporting on enterprise risks is conducted as needed or as requested by the Board or the Audit Committee. The Compensation Committee annually reviews our overall compensation programs and their effectiveness in aligning executive pay with performance in the interests of shareholders, as well as social and human capital-relatedBoard’s risk oversight issues. The Corporate Governance and

|

Ducommun Incorporated 2021 Proxy Statement

Nominating Committee reviews and makes recommendations tofunction did not significantly impact its selection of the Board concerning ourcurrent leadership structure, director independence and oversees ESG issues. The Innovation Committee is responsible for assisting the Board in fulfilling its oversight responsibilities concerning technology-related opportunities and issues of strategic importance to us.structure. The key risk oversight responsibilities of each of the Board’s committees are depicted in the diagram below.below:

| |2024 Proxy Statement15 |

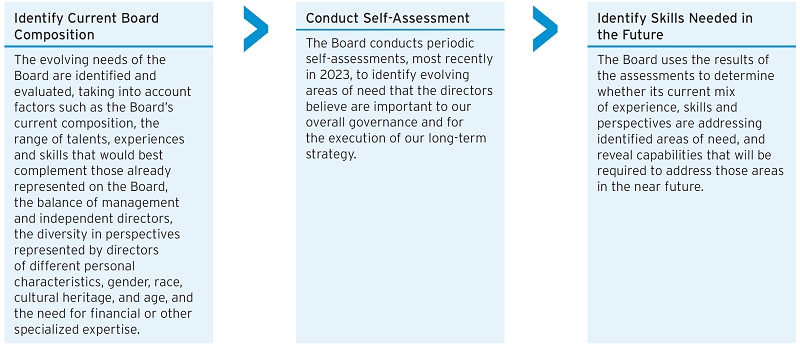

Nominating Process

The Corporate Governance and Nominating Committee believes that all Committee-recommended nominees for election as a director of Ducommun must, at a minimum, have:

| • | relevant experience and expertise; | |

| sound judgment; | |

| • | a record of accomplishment in areas relevant to our business activities; | |

| • | unquestionable integrity; | |

| • | ||

| • | independence, and the absence of potential conflicts with Ducommun’s interests; | |

| • | the willingness to devote sufficient time, energy, and attention in carrying out the duties and responsibilities of a director; and | |

| • | the willingness to serve on the Board for an extended period of time. |

Ducommun Incorporated 2021 Proxy StatementIn identifying candidates to serve on the Board, the Corporate Governance and Nominating Committee follows the process delineated in the diagram below.

In prior years, the Corporate Governance and Nominating Committee determined that the Board would benefit from additional expertise in the areas of product strategy, human capital management and finance. The committee retained Spencer Stuart, an outside search firm, to conduct searches for the best qualified candidates in these fields, which utilized a disciplined process that included research and reviewing the firm’s global database and network of contacts. As a result, Spencer Stuart’s searches identified Ms. Drazba, Ms. Kramer and Ms. Strycker from competitive pools of candidates.

More recently, the Corporate Governance and Nominating Committee determined that the Board would benefit from additional expertise in the areas of engineering, product development and additional functional expertise. Accordingly, the committee once again retained Spencer Stuart to conduct a search for the best qualified candidates in these fields and as a result of its process, identified Mr. Carter from a competitive pool of candidates.

All director candidates considered for nomination by the Corporate Governance and Nominating Committee must complete a questionnaire, provide such additional information as the committee may request, and meet with our sitting directors.

The CompensationCorporate Governance and Nominating Committee reviewswill consider director candidates recommended by shareholders in accordance with the risks associated withprocedures set forth in Article II Section 13 of our compensation policiesAmended and practicesRestated Bylaws. Shareholders may submit the name of individuals for executive officers and employees generally. The Compensation Committee didconsideration as a director candidate not identify any risks arising from these policies and practices that are reasonably likelylater than the close of business on the ninetieth (90th) day nor earlier than the close of business on the one hundred twentieth (120th) day prior to have a material adverse effect on us. In the course of its review, the Compensation Committee considered various featuresfirst anniversary of the compensation policiespreceding year’s annual meeting. The Corporate Governance and practicesNominating Committee considers and evaluates candidates recommended by shareholders in the same manner that discourage excessive risk taking, including, but not limited to, the following:it considers and evaluates other director candidates.

| |2024 Proxy Statement16 |

|

| |

| ||

|

| |

| ||

| ||

| Back to Contents | ||||

|

Ducommun Incorporated 2021 Proxy Statement

Committees of the Board of Directors

COMMITTEES OF THE BOARD OF DIRECTORS

The Board is responsible for overseeing our enterprise risk management program, including but not limited to cybersecurity risks, and ESG issues. These responsibilities are fulfilled both directly and indirectly through the Board’s standing committees, each of which assists in overseeing a part of our overall risk management.

We have four standing Board committees: the Audit, Committee, the Compensation, Committee, the Corporate Governance and Nominating, Committee, and Innovation. All committees, other than the Innovation Committee.Committee, are made up entirely of independent directors. The membership, specific roles and responsibilities, and other information related to each committeecharters for all four committees are summarizedavailable on our website at https://investors.ducommun.com/corporate-governance. Shareholders may request paper copies of any charter by contacting Ducommun Incorporated, 200 Sandpointe Avenue, Suite 700, Santa Ana, California 92707-5759, Attention: Corporate Secretary.

Audit Committee

Seven meetings in the table below and described in the pages that follow.2023 (100% attendance)

|

|

|

|

|

| ||||

Richard A. Baldridge | |||||||||

| |||||||||

| |||||||||

Robert C. Ducommun | |||||||||

| |||||||||

Jay L. Haberland | |||||||||

|

* Committee Chair

|

Ducommun Incorporated 2021 Proxy Statement

| ||

| All of the members of the Audit Committee meet the independence criteria of the NYSE’s listing standards. The Board, in its business judgment, has determined that Ms. Strycker and each of Messrs. Baldridge, Ducommun, and Haberland are “financially literate,” under the NYSE listing standards and that Ms. Strycker and Mr. Haberland

The

•

•

•

•

• In conjunction with the Board as a whole, assists in the oversight of cybersecurity and data privacy disclosure risks; •

•

|

| |2024 Proxy Statement17 |

Compensation Committee

Four meetings in 2023 (100% attendance)

|

Ducommun Incorporated 2021 Proxy Statement

| ||

Shirley G. Drazba

| All of the members of the Compensation Committee meet the independence criteria of the NYSE’s listing

The

•

•

•

• Selects and retains an independent compensation consultant, currently, Willis Towers Watson, to provide consulting services relating to our executive compensation program; •

•

•

•

•

•

•

|

Corporate Governance and Nominating Committee

Three meetings in 2023 (100% attendance)

|

Ducommun Incorporated 2021 Proxy Statement

| ||

Dean M. Flatt | All of the members of the Corporate Governance and Nominating Committee meet the independence criteria of the NYSE’s listing standards.

The Corporate Governance and Nominating Committee

•

•

•

•

•

•

•

•

•

team in conjunction with the Compensation Committee. |

| |2024 Proxy Statement18 |

Innovation Committee

Three meetings in 2023 (100% attendance)

|

Ducommun Incorporated 2021 Proxy Statement

|

| ||

Richard A. Baldridge

|

The

•

•

• In conjunction with the Board as a whole, oversees information technology, including cybersecurity, data privacy, and such other technology-related matters as the Committee deems appropriate (other than the Company’s public reporting obligations with respect to cybersecurity for which the Audit Committee is responsible); •

•

|

Annual Board and Committee Evaluations

|

Ducommun Incorporated 2021 Proxy Statement

ANNUAL BOARD AND COMMITTEE EVALUATIONS

The Corporate Governance and Nominating Committee, together with the Lead Independent Director, coordinates regular Board performance evaluations. These evaluations are conducted through a combination of formal and informal processes, including the following, among others:following:

The Board, along with each of its committees, annually conducts a self-evaluation of its performance.

| • | The Board, along with each of its committees, annually conducts a self-evaluation of its performance which includes considerations as to the composition of the Board and its committees; whether committee charters, meeting content, and the amount of time dedicated to agenda items are appropriate; members’ concerns about the Board’s performance and that of its individual committees; and suggestions for addressing such issues. |

| • | At the end of each regular Board meeting, the Board holds an executive session at which feedback on the meeting is provided to the Lead Independent Director. |

| • | The Nominating and Corporate Governance Committee, in conjunction with the Lead Independent Director, periodically reviews the composition of the entire Board to assess the skills, experience and perspectives that are currently represented on the Board, and to determine what skills and experience would be valuable in the future given our current state and strategic plans. |

At the end of each regular Board meeting, the Board holds an executive session at which feedback on the meeting is provided to the Lead Independent Director.

The Nominating and Corporate Governance Committee, in conjunction with the Lead Independent Director, periodically reviews the composition of the entire Board to assess the skills, experience, and perspectives that are currently represented on the Board as well as those the Board believes will be valuable in the future given our current state and strategic plans.

Feedback from these processes is communicated to the Chair of the Board, the Chair of the Nominating and Corporate Governance Committee, and the Lead Independent Director so that appropriate follow-up measures can be discussed, implemented and monitored.

As discussed in the “Nominating Process” section above, as a result of such recent self-evaluations, the Board oversees risk managementdetermined that it would benefit from additional proficiency in the areas of engineering, product development and functional expertise. Our newest director, Mr. Carter has enhanced the Board with these and other areas of expertise since his appointment. We are also thrilled that currently, over 40% of our Board is composed of women and a member of an underrepresented background, which is expected to be 50% immediately following the election of directors at the Annual Meeting.

Director Orientation and Continuing Education

Ducommun provides an orientation program for all new directors not only with respect to their role as directors, but also as members of the Board committees on which they will serve. In addition, Ducommun provides ongoing education and development for its directors to help them continuously improve their contributions as individual directors and collectively as a wholeBoard, and pays for all reasonable expenses for any director who wishes to attend external continuing education programs.

| |2024 Proxy Statement19 |

Shareholder Engagement

Our Board values the perspectives of our shareholders, who have placed their trust in Ducommun and its Board. We expect to engage regularly in meaningful conversations with shareholders concerning our business, executive compensation, corporate environmental and social responsibility, and other governance topics.

To this end, in 2023, we continued to engage with our shareholders, including our top 25 most active institutional investors. We also met with several new investors as we continued to make efforts to broaden our shareholder base through a follow-on stock offering in May 2023. After completion of the follow-on offering we also actively engaged with our key existing investors to address any related questions or concerns. Our Board believes that such candid and specific feedback from its Committees.shareholders will enhance our governance, social responsibility and compensation practices, and will contribute positively to Ducommun’s mission, performance and return to shareholders. A summary of our Board’s Committee’s charters and our governance documents can be visualizedengagement efforts, along with actions taken in response to shareholder feedback is summarized in the table below.tables below:

2023 Shareholder Engagement Key Statistics

Management attended more than 100 meetings with existing and potential new investors and more than 15 with research analysts in 2023.

2023 Shareholder Engagement Overview

| Who External | Ducommun | How | Resources https://investors.ducommun.com/ | |||

| • Institutional Investors | • Executive Management | • Fireside chats at Analyst Conferences | • Quarterly and annual earnings publications | |||

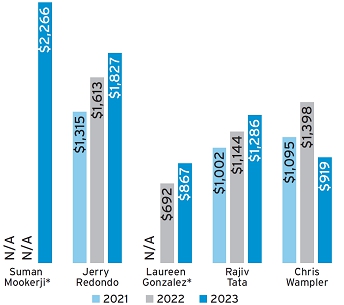

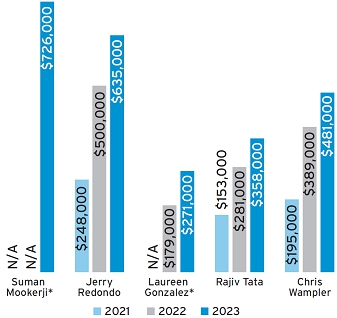

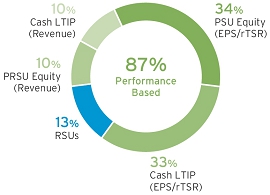

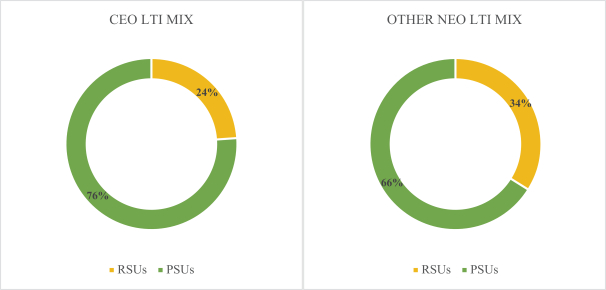

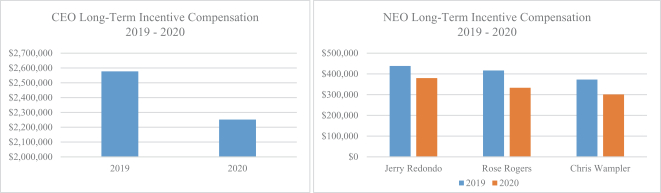

| • Sell-side analysts | • Investor Relations | • Quarterly earnings calls | • Annual proxy statements and reports, and SEC Filings | |||